Is The Public Officer Group Insurance Scheme A Good Buy?

- Vincent Chua

- Sep 23, 2019

- 4 min read

Updated: Sep 24, 2019

Recently, I was asked by a couple of friends if the Public Officer Group Insurance Scheme (POGIS) is a good buy.

For those who are new to POGIS, below is the description from the company.

When you work in public service, you dedicate your life to serving the nation. As you continuously strive to make an impact on other lives, it's important to know that your needs and that of your loved ones are well taken care.

That's why we introduce the Public Officers Group Insurance Scheme (POGIS) — a plan that cares for your family while stretching your dollar.

Currently, Aviva is the main insurer providing POGIS.

POGIS' premiums, for the majority currently, is much more affordable than most individual term plans in the market.

Since the term plan is very similar to other term plans, is it a good buy for POGIS then?

Below we take a look at how POGIS differs from individual term plans.

1. Definition Limitations

Below are the definitions for the disability coverage.

POGIS Disability Definition

This set of definitions are based on the severance of our limbs or loss of sight.

Below are definitions of disability from most individual term plans in the market.

Individual Term Plans Definition

As you can, points 1 and 2 are similar.

There are additional points for individual term plans.

This allows the insured to claim in the event of any circumstances from point 1 to 5.

And for those who are unaware of what the Activities of Daily Living (ADLs), here's the definition from the Ministry of Health.

As such, based on the disability definition, individual term plans are more comprehensive than POGIS.

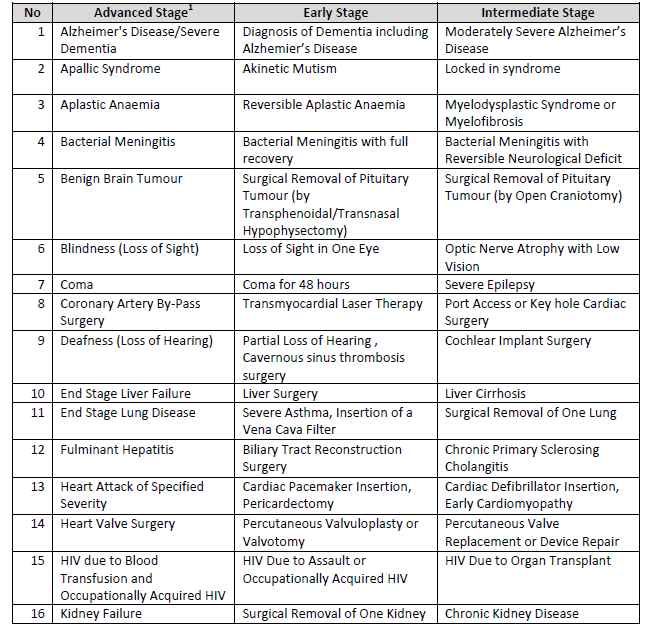

Another key thing to note is the definition of early critical illness.

POGIS Early Critical Illness Definition

Individual Term Plan Early Critical Illness Definition

Screenshot from Company M Product Summary

Most of the individual term plans with early critical illness riders cover more than 10 illnesses.

Do note that each company has its own set of early critical illness definition.

(Please check with your financial advisor on the definitions for your own plans.)

Again, individual term plans are more comprehensive.

Score: POGIS 0 - 1 Individual Term Plan

The individual term plans are more superior than POGIS in terms of definition.

2. Premiums Comparison (5 Years Structure)

Here comes the meat of it.

Depending on your age and the duration which you wish to cover for, the pricing could differ significantly.

Below is a quote based on a male, non-smoker, age 38 (next birthday).

Assuming the coverage is just 5 years, the premium for POGIS is pretty affordable.

The total amount on the right column is based on the cumulation of the annual premiums.

On CompareFirst, Company F came up the cheapest for this structure.

Company F's annual premium is $677.52 without 100k Early Critical Illness coverage.

(I couldn't add in the Early Critical Illness as Company F does not have the option.)

Aviva POGIS: $630/ year

Company F: $677.52/ year

Score: POGIS 1 - 1 Individual Term Plan

In this case, whichever plan that can provide the cheapest pricing wins. Hence, victory to POGIS for this round.

3. Premiums Comparison (Until Age 70)

Given that a term plan is usually meant to cover our working years, let's see if POGIS is affordable as it extends to age 70.

From the graph, we can see the pricing starts to spike after age 65.

It gets crazier after age 70.

The cumulative premium from age 38 to 70 is $105,442.

Do note that the total premium is based on the current product summary provided by the company. The company reserves the right to adjust the premiums down the road given that this is a group insurance scheme.

Another important thing to note is that from the age of 66 to 70, the coverage of death and disability drops to a maximum of 300k.

On CompareFirst, company T comes out at the top.

The annual premium from company T is much more expensive than Aviva's POGIS.

One interesting thing to note is that the total capital, on the other hand, amounts to $83,504.

Total premiums till age 70

Aviva POGIS: $105,442

Company T: $ 83,504

Another key aspect to note is that the death and disability benefit for company T remains the same at 500k from age 66 to 70.

Score: POGIS 1 - 2 Individual Term Plan

This is a straight forward win. The cheaper premium wins this round.

TL;DR

Both POGIS and individual term plans have their own strengths and weakness and each plan caters to different groups.

The question comes back to your needs, objectives and respective situations.

Aviva POGIS is a very affordable scheme during your early working years.

And to take a step back, the official retirement age is 62. As such, it may a good purchase if you are looking to have a working life cover until that age.

If you are looking for a longer-term coverage or would like to leave a legacy for your loved ones, then you may want to supplement with individual term plans.

Disclaimer: This article is based on my personal view. The information provided here is not meant to serve as advice to switch/ buy/ replace your existing plans. I am not representing any company/ organization to write this article. Do seek your financial advisor for further advice as each of our situations differ.

Do note that the information is accurate as of 23 Sep 2019. Any further changes will not be reflected in this article.

Comentarios